No one would call me a cryptocurrency expert, and maybe that’s why bitcoin speculators should listen. Granted, the math and technology is beyond most people’s comprehension. But this week in NYC, as the value of Bitcoin soared yet again, I saw why what goes up must go down. There are lots of old truisms about investing. When your hairdresser, or millions of individual unschooled investors in China, or a New York fashion-photographer-turned-crypto-evangelist tells you to “get in on the game”, reason says run for the exits.

请点击这里阅读中文版。 本文由来自上海的王豪盛翻译.

While in New York for an innovation conference, I was invited to a women’s tech event, held by a “global collective of ambitious female entrepreneurs.” No, the topic wasn’t female founders, or perfecting your pitch, but the mania of the moment. The event blurb teased: “Interested in getting into the crypto game?” Thirty or so women (and a couple of men) came together in a swanky co-working space for the media, fashion and design industry (no hoodies here; everyone was slim, gorgeous, dressed to the nines) near Madison Square. Two lanky blondes in fashionable, form-fitting leggings took the stage, one a cryptocurrency “industry expert”, who just happened to be a fashion photographer and marketing consultant by trade, and the other a technologist with experience in managing blockchain projects. The theme of the talk: “It’s not too late!”

The first blonde bitcoin expert never quite shared her credentials. We did learn that she was a fashion photographer, that she’d heard about cryptocurrency a few years ago and invested a small amount but “kind of forgot about it until this summer”, when she came up with the idea for a token-based platform to match modeling talent with brands. She seemed giddy about how much she’d “made” by buying – and not selling – her bitcoin (never quite sharing how much she was talking about). She exuded confidence. She was looking for converts.

Advice from a Non-Advisor

“I always advise people, but I’m not a financial advisor, and this is not financial advice, this is just what I do,” she said, sounding very much like someone who shouldn’t be giving financial advice. “50% Bitcoin, 25% Ethereum, 25% Litecoin, and don’t invest more than 10% of what you’re willing to lose. And then once you do that for a little while, possibly get into altcoins. There’s some very interesting altcoins right now that I’m involved in. I’m invested in OMG, Ripple, and Bitcoin cash. I just love the feeling of owning my own money!”

A different kind of advice came this week from another woman who’s a true industry expert, with a PhD in Economics from Yale and current job title as head of the Federal Reserve. Janet Yellen went on record stating that bitcoin right now is “a highly speculative asset,” adding that “undoubtedly there are individuals who could lose a lot of money if bitcoin were to fall in price.” A top UK regulator said it even more forcefully, telling the BBC on the same day I attended this event: “If you want to invest in bitcoin, be prepared to lose all your money.”

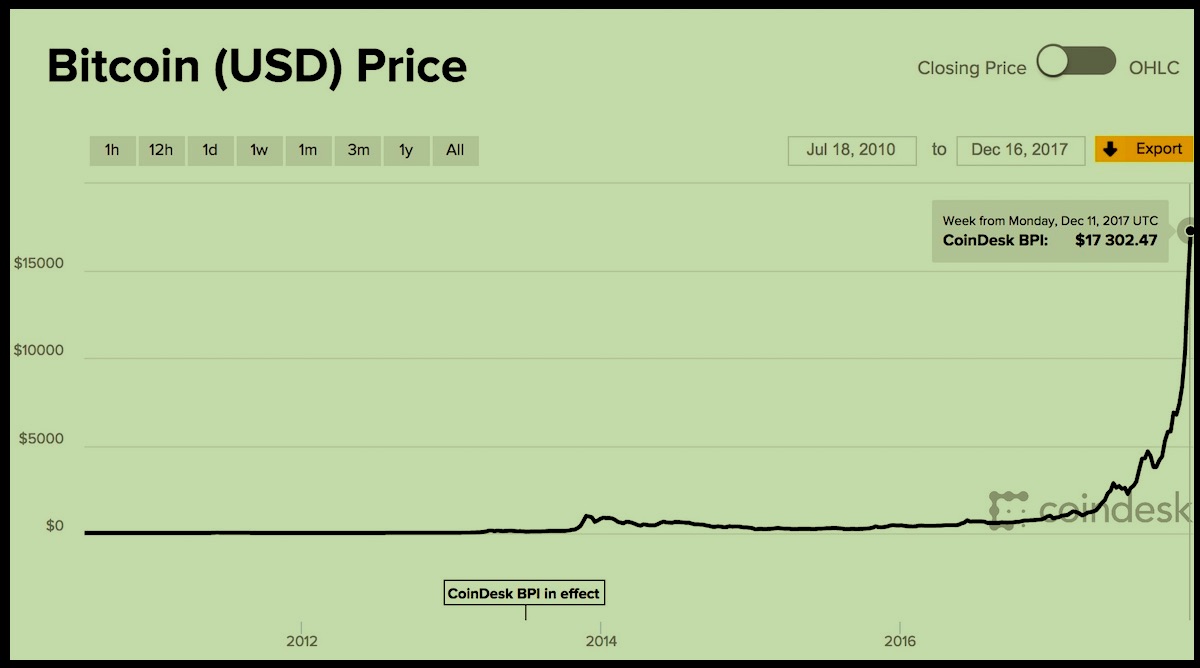

As I sat in the audience pondering what I’d read in the news, I wasn’t quite ready to follow the fashion photographer off the cliff. Upon reflection I have some advice of my own. Please, please just look at the seven-year bitcoin chart. Yes, the picture above this story. Examine how the line has soared up this year – turning every dollar invested into bitcoin into twenty. Consider also what happened in the dot-com crash of 2000 to 2002, and the housing crisis of 2008 – when every dollar turned into 50 cents, a quarter, or nothing (which may have meant losing your house or life savings) in just months. Get a visceral sense of this line soaring to the stratosphere, and how it will hit you in the gut. Have you ever ridden a roller coaster after lunch? Think about that for a moment.

The Dark Side

The blondes wouldn’t tell us the basics, but I will. Bitcoin is mined by people running computers to solve complex math problems. Solve the math and this adds a “block” to the chain and the miner wins bitcoin. Bitcoin is dirty money, as Wired just wrote. Today, the process of mining the coins uses more electricity than all of Serbia, “and by November of 2020, it’d use more electricity than the entire world does today.” But even if you don’t care about the dark paradox here – killing the planet for a cryptocurrency, you the investor might consider that if you are just getting the message now you are ideally positioned to lose your shirt. Being late to a pyramid party is risky business.

The blondes wouldn’t tell us the basics, but I will. Bitcoin is mined by people running computers to solve complex math problems. Solve the math and this adds a “block” to the chain and the miner wins bitcoin. Bitcoin is dirty money, as Wired just wrote. Today, the process of mining the coins uses more electricity than all of Serbia, “and by November of 2020, it’d use more electricity than the entire world does today.” But even if you don’t care about the dark paradox here – killing the planet for a cryptocurrency, you the investor might consider that if you are just getting the message now you are ideally positioned to lose your shirt. Being late to a pyramid party is risky business.

And then there’s the criminal element. North Korea is behind major hacking attacks designed to steal the currency, as well as using it as ransom payment. In May of this year, in the notorious WannaCry ransomware attack in which people around the world were attacked by a malware program that locked their computers and demanded money to unlock, the attackers received thousands of dollars in the form of bitcoin. Because bitcoin is relatively untrackable, it’s favored among criminals to launder drug dealing and prostitution spoils.

Twenty percent of the world’s bitcoin trading is happening in South Korea, where it seems everyone, including shopkeepers and laborers, wants in on the action. This mania has spread to a little place called China, where millions, the vast majority with no experience in traditional investing – the same investors accustomed to crazy, state-goosed returns in Chinese real estate funds – are pouring their savings into cryptocurrencies. The Wall Street Journal recently noted that the rampant Chinese market was a huge factor in bitcoin’s surging price. In the UK, “How to buy bitcoin” was the second most asked ‘How to’ question of the year. The promotional crypto event I attended last week tells me New Yorkers are piling in on the craze just as exuberantly.

The photographer talked about the logistics of opening up an account on the most popular bitcoin trading exchange, Coinbase. There are many others, of course, and at one point during the talk an audience member announced she’d just opened an account on Bittrex (at which point she was scolded and told to use the more mainstream Coinbase). Since these exchanges are all unregulated, holding an account there assumes a lot of risk. In 2014, the dominant trading platform Mt. Gox collapsed, and more than 24,000 customers around the world lost access to hundreds of millions of dollars in cryptocurrency – and cash. To date, as Reuters has reported, “not a single customer has recouped a single cent, crypto or otherwise.” Mt. Gox isn’t the only exchange to collapse, it’s just one of the few that actually ended up in bankruptcy court; others just vanished.

Now let’s talk about the people factor. US stocks are no sure bet, but the best of these stocks are held by professional investors, funds, companies and individuals. A reasonable number of these investors are rational, educated, and experienced, and aim to hold these securities for months or years. Individual stock prices are tied to real products and services on the market – with commensurate revenues, projected sales, customers, growth, and other factors determining their valuation. Bitcoin, on the other hand, has no physical form, and no one behind it besides a pseudonymous founder, or group of founders, named Satoshi Nakamoto. Transactions are made with no middle men – meaning, no bankers or banks. In addition, international payments are easy and cheap because bitcoins are not tied to any country or subject to regulation. There’s mystery and intrigue behind who’s truly pulling the strings.

There’s neither a “there” nor a “their” there.

Markets: Crypto, Stocks, and Tulips

But the photographer loves bitcoin’s crash pattern. “I heard last week that, like, with the big three cryptos, you can always expect them to crash, like they have been, and then people tend to, like, freak out and sell,” she said, adding “I heard that in the past year, bitcoin has dropped in value by a third, five different times, only to, like, a month later, triple in value. Like, five times. Like, that’s a pattern. But it’s not a pattern that’s seen in stocks. Like, people are talking now, like, we can’t really compare it to the stock market. But, like, what I do? I just hold. I don’t even, like, touch it. I don’t even look at it.” In reality, over the past five years, bitcoin has crashed at least five times, including an overnight drop of 70 percent, and a little fact the photographer neglected to mention. Timing is everything with crazes. Bitcoin hit a high in 2013 and then plummeted and didn’t reach that peak until early this year – a four-year trough.

But the photographer loves bitcoin’s crash pattern. “I heard last week that, like, with the big three cryptos, you can always expect them to crash, like they have been, and then people tend to, like, freak out and sell,” she said, adding “I heard that in the past year, bitcoin has dropped in value by a third, five different times, only to, like, a month later, triple in value. Like, five times. Like, that’s a pattern. But it’s not a pattern that’s seen in stocks. Like, people are talking now, like, we can’t really compare it to the stock market. But, like, what I do? I just hold. I don’t even, like, touch it. I don’t even look at it.” In reality, over the past five years, bitcoin has crashed at least five times, including an overnight drop of 70 percent, and a little fact the photographer neglected to mention. Timing is everything with crazes. Bitcoin hit a high in 2013 and then plummeted and didn’t reach that peak until early this year – a four-year trough.

These people – and the blondes in front of me — don’t remember (or think about) the Great Tulip Mania in Holland, which turned a dollar into a penny, the US stock market crash of 1929-1932 which turned a dollar into a dime, or the dot-com crash, of 2000 to 2002 which turned a buck into less than a quarter.

Having just been to Slovenia, where I spent a few days last month with true crypto experts, I recalled their educated predictions. Those guys told us they expect bitcoin to shed 95 percent of its value. To put that in perspective that would mean that a dollar invested in bitcoin would become a nickel. That a thousand dollars would become fifty bucks, that this fashion photographer’s $10,000 booty would drop to a measly $500.

The photographer doesn’t know these Slovenians. She didn’t study computer science or economics. She may not be aware that hackers just made off with close to $62 million in a Slovenian bitcoin heist. She only sees bitcoin rising, rising, up and up into the stratosphere.

“How high can it go?” asked one attendee.

“I can only repeat what other people have said. I am not a financial person. People have said, like, a million dollars for one bitcoin,” cheered the photographer, who declared she’s ready to play the long game. She’s going to hold her bitcoin “for, like, 20 years.”

Or until that roller coaster crashes down.

谨防狂热的比特币

没有人称我为加密货币专家,也许这就是为什么比特币投机者们应该听一下我的话。当然,数学和技术超出了大多数人的理解范围。但是我在纽约的这个星期,随着比特币的价值再次暴涨,我也看到了为什么比特币上涨之后就会下跌的原因。关于投资有很多陈旧的看法。当你的理发师,或者中国数百万的未受专业教育的投资者,又或是一个纽约时装摄影师变成加密货币的传道者告诉你应该“加入游戏”时,这些理由足够说服你迅速离开这场游戏。

我在纽约参加创新大会时,我被邀请参加这个由“来自全球各地雄心勃勃的女性企业家们”举办的女性科技活动。不,这里话题不是女性创始人,也不是让你的演讲出彩,而是关于这个狂躁的时刻。这次活动的导语是:“有兴趣进入加密游戏吗?”三十多名女性(和几个男性)聚在这个专为媒体,时尚和设计行业提供的共用工作空间(这里没有人穿帽衫,每个人都是苗条,华丽,从头打扮到脚)地处于麦迪逊广场附近。两位身着时髦紧身裤的瘦高金发女郎走上舞台,一位是加密货币“行业专家”,她是时尚摄影师和行业营销顾问,另一位则是在区块链项目管理方面经验丰富的技术专家。谈话的主题是:“现在还不算晚!”

第一个金发碧眼的比特币专家从来没有分享她的专业证书。我们确实知道她是一位时尚摄影师,几年前她听说过加密货币,并投入少量资金,但“直到今年夏天才想起来她买过这些货币”,当时她提出了一个代币的平台将模特人才与品牌相匹配的想法。她似乎对自己买了比特币而没有卖掉的事情含糊不清而且她也(从未透露过她有多少比特币)。但是她散发出了信心。她正在寻找追随者。

来自一个非专业人士的建议

金发女士说道:“我总是给人们建议,但我不是财务顾问,这也不是财务建议,这正是我所做的。”她说,听起来很像一个不应该提供财务建议的人。 “50%的比特币,25%的以太币,25%的莱特币,总金额不要超过你愿意输掉的10%。然后一旦你这样做了一段时间,可能会进入其他币种。现在有一些非常有趣的币种,我参与了OMG,Ripple和Bitcoin的投资。我只是喜欢拥有自己的钱的感觉!“

本周,另外一位女士也提供了一条建议而她是一位真正的行业专家,她拥有耶鲁大学经济学博士学位,现任美联储主管。珍妮特·耶伦(Janet Yellen)表示,比特币现在是“一种高度投机的资产”,并补充说,“如果比特币价格下跌,个人们可能会损失很多钱。”英国一家顶级监管机构也发布了相关言论,它们的说法甚至更有力,在我参加这个活动的同一天这家机构告诉英国广播公司:“如果你想投资比特币,准备失去你所有的钱。”

当我坐在观众席上思索我在新闻中看到的内容时,我还没有准备好跟随时尚摄影师的内容。经过反思,我有一些自己的建议。请看看这七年的比特币图表。是的,这个故事上面的图片。研究一下今年这条线是如何飙升的 – 将投入比特币的每一美元都变成二十美元。也考虑一下2000年到2002年的网络崩溃以及2008年的房地产危机 – 在短短几个月里,每一美元却缩水成了50美分,25美分,或者什么也没有(这可能意味着失去你的房子或者储蓄) 。感受一下这条线的澎湃感,以及它将如何打击你。不知道你有没有试着午饭过后去骑过山车?请仔细想一下这种感受。

黑暗面

金发女郎不会告诉我们的基本知识,但我会的。比特币是由人们运行计算机解决复杂的数学问题而开采获得的。解决这个数学问题,这就给链条增加了一个“区块”,矿工将会赢得比特币。比特币是肮脏的钱,正如Wired杂志刚刚写道,今天开采金币的过程比塞尔维亚国家所用的电力要多,“到2020年11月,电力的消耗量将超过整个世界。”但即使你不在意这里的黑暗悖论 – 为一个加密货币杀死这个星球,对投资者来说,如果你现在才知道这些信息已经太迟了,迟到金字塔派对是危险的事情。

然后是犯罪分子。今年五月,在臭名昭着的WannaCry勒索软件攻击中,全球各地的人都遭到了一个恶意程序的攻击,该程序锁定了他们的电脑,并要求交付解锁资金,攻击者以比特币的形式收到数以千计的美元。因为比特币相对来说是无法跟踪的,所以从事洗钱和毒品贩卖犯罪分子们非常喜欢比特币。

世界上20%的比特币交易正在南韩发生,在这里,包括店主和劳工在内的每个人都想要采取行动。这种狂热已经蔓延到了中国,那里有数以百万计的没有传统投资经验的投资者,这些投资者习惯了中国房地产基金疯狂的回报,正在把他们的储蓄投入到加密货币中。华尔街日报最近指出,中国猖獗的市场是比特币价格飙升的一个重要因素。在英国,“如何购买比特币”是今年第二个最受关注的以“如何”开头的问题。上周我出席的加密货币活动告诉我,纽约人正在热情地涌入。那个金发的摄影师谈到在最受欢迎的比特币交易所Coinbase上如何注册。当然还有很多其他的东西,在谈话过程中,观众中的一位成员宣布她刚刚在Bittrex上开了一个账户(当时她立马被训斥,并被告知要使用更为主流的Coinbase)。由于这些交易全部不受管制,因此在那里持有一个账户承担了很大的风险。 2014年,主导交易平台戈克斯崩溃了,全球有超过24,000个客户失去了数以亿计的加密货币和现金。据路透社报道,迄今为止,“没有一个客户收回了一分钱,密码或其他”。戈克斯并不是唯一一个倒闭的交易所,它只是在破产法庭中真正结束的少数几个交易所之一;很多其他交易所则直接消失。

现在让我们来谈谈人的因素。美股也不是可靠保本的投资,但最好的股票是由专业投资者,基金,公司和个人持有的。合理数量的这些投资者是理性的,受过良好教育的,经验丰富的,目的是持有这些证券或股票数月或数年。个别股票价格与市场上真实的产品和服务有关 – 由相应的收入,预计的销售额,客户,增长和其他决定其估值的因素组成。另一方面,比特币没有物理形式,除了一个名叫Satoshi Nakamoto的假名创始人或创始人小组之外,没有任何人背书。交易没有中间人,没有银行专员或银行。此外,国际支付是简单而便宜的,因为比特币不受任何国家的约束或受制于法规。

这是一个没有国界和人群限制的空间。

市场:加密货币,股票和郁金香

但金发摄影师喜欢比特币的崩溃模式。她说:“上周我听说,就以三大加密货币为例,你总是可以期待它们像以前一样崩溃,然后人们就会恐慌并且卖出他们的货币。”她补充说:“我听说在过去的一年中,比特币的价值已经下降了三分之一,在五个不同的时间节点,仅仅到一个月后,价值就翻了三番。这五次就像是一个模式。但这不是股票的模式。就像现在人们正在谈论的那样,我们无法真正把它与股市进行比较。但是,我是怎么做的呢?我只是持有着。我不会去碰它。我甚至不看它。“事实上,在过去的五年里,比特币已经崩溃了至少五次,包括一夜之间下降了百分之七十,还有一点是摄影师忽视的。时机是这场疯狂机遇的一切。比特币在2013年创下高点,然后直线下滑,直到今年年初才达到峰值 – 这是一个四年低谷。

这些人 – 和我面前的金发女郎 – 不记得(或者想到)荷兰的郁金香疯狂,把一美元贬值成了一美分,美国1929 – 1932年的股市崩盘,把一美元贬值成了十美分,或者2000年到2002年的网络崩溃,把一美元贬值到四分之一的价值。

我刚刚去过斯洛文尼亚,上个月我和真正的加密货币专家一起呆了几天,我回想起他们的预测。那些人告诉我们,他们预期特币会贬值95%。从这个角度来看,这意味着投资比特币的一美元将成为五美分。一千美元就会变成五十美元,这位时尚摄影师的一万美元的战利品就会下降到可怜的一千美元不到。

这位摄影师并不知道这些斯洛文尼亚。她也没有学习过计算机科学或经济学。她可能并不知道黑客在斯洛文尼亚的比特币抢劫案中获得了将近6千多万美元的利润。她只看到比特币上升,上升,进入平流层。

“比特币将会有多高?”一位参与者问道。

“我只能引用别人的话。我不是一个经济专家。人们说一个比特币在将来可能值一百万美元,“摄影师说,她已经准备好玩这个漫长的游戏了。她要把她的比特币“放置20年”。

或者直到过山车坠毁。