Susanna: Let’s talk about Web3. There’s an emerging 1-2-3 narrative for defining this exciting evolution. That is, Web1 was read, Web2 was write, and Web3 is own. Give us a sense of the progression from the early Web, particularly with regards to digital ownership.

[This is Part 2 in our Web3 interview series with inventor, entrepreneur and serial founder Ron Martinez.]

Ron: Web1 was built on a publishing model, very much like a digital newspaper or publication. People published webpages and sites full of information, in a broadcast-media sense. You were a receiver. They were the sender. It was basically read-only.

Susanna: Right. So the relationship between creator and consumer was fundamentally different.

Surveillance Capitalism and the Rise of Sovereign Identity

Ron: Yes. In Web2 (a term coined by Tim O’Reilly), the web became a read-write experience. You could write, you could blog, there were comments. Wikipedia was a great Web2 breakthrough, because anybody could edit the entries, you could share knowledge. In terms of the creation and consumption of information, this move from read-only to read-write was transformative. And it paved the way for the social web.

But in Web2, you don’t own your personal information. In principle, you might be able to export it from, say, Facebook or another source, but otherwise it gets collected by and used for the benefit of those who operate the platform. In fact, what emerged is what some people call surveillance capitalism. You have these friends, and you pay attention to these movies, and you have these other interests, and companies sell that information about you to an advertiser so that they can get better targeting to increase their revenues.

Web3 adds a different principle and mechanism drawn from what we like to think of as the real world. About 10 years ago I and my colleagues at Invention Arts engaged in a project with TEKES [then Finpro], the Finnish Funding Agency for Innovation. It was about reimagining personal information, identifiable information, the exhaustive metadata you emit as you move through your day with your phone. If you don’t want some unseen agent or algorithm knowing everything about you and selling that to someone else, you might be willing to trade some of this information for the benefits of the service. The project evolved into a World Economic Forum track. And I see that now blossoming in Web3.

If we reimagine our personal data as a new asset, a class of asset that we control, where we are empowered to trade our data for benefits, it changes the model dramatically. This is known as sovereign identity. There are a number of people focused on this, such as Drummond Reed, and Kaliya Young, a.k.a. Identity Woman. Personal ownership is foundational. Because if you don’t have an identity, how can you own anything?

Susanna: So let’s talk about that for a minute – this new mechanism of blockchain and the underlying technology that supports ownership in Web3.

Ron: Ownership comes mainly through receiving one or more identifiers. Your identifiers are unique, and cryptographically enforced. Typically when you create a wallet, you’ll create an account in that wallet. That account has a passphrase that you save somewhere, and you are the only one who knows that passphrase. It doesn’t live on a server somewhere where someone else has the ability to take your passphrase and light up your identity. It lives on the blockchain.

You can think of the blockchain as a public information utility that no one individual, entity or company controls. It’s an indelible record of sovereign identity. Typically there are balances associated with it, and transaction records. The blockchain is also referred to as a distributed ledger. Because it’s encrypted, when you engage in a transaction, the other side, whatever that service is, may know nothing else about you, where you live, who you are, what else you do in the world. All it knows is that there is an identity that has accounts and balances of assets with transaction histories. These are recorded on the distributed ledger, which cannot be modified by any of the people who interact with it.

Susanna: Now that we’ve established some of the underlying technology, let’s talk about the blockchain trilemma, the belief that decentralized networks can only provide two of the three benefits at any given time with respect to decentralization, security and scalability. I can see the risks to security when you’re developing code, particularly if you have to store things off-chain, maybe on a local drive or cloud server, which would introduce vulnerabilities. What are some other problems, and where do you think we are in terms of the ability of Web3 to meet the challenges of the trilemma?

How to Achieve Speed and Scale

Ron: I think that puts a finger on it. But a lot of this stuff happens at the protocol level, not at the decentralized application [dApp] layer of the stack. A lot of it revolves around proof of work versus proof of stake. Ethereum has a very rigorous way to achieve validation, ensuring the integrity of the blockchain’s data. There are validators, people who are operating nodes of the network, all of which have to be in sync and agree with one another about the state of that ledger, including all the accounts and all the balances. In the case of Ethereum (and Bitcoin before it), this is accomplished using proof of work.

Proof of work is very rigorous and reliable when it comes to decentralization and security, but it doesn’t scale. You have a throughput problem. Bitcoin can do maybe 7 transactions per second. Ethereum can do about 15 TPS. Whereas Visa can do hundreds of thousands per second, because it’s not decentralized. Finality is another limitation. Depending on the chain, it can take 15 minutes or more to finalize a transaction.

That’s an inhibition on scaling that network. There are technical strategies for dealing with this that core protocol teams are working on. You can move to a different model with sharding, a way of dividing up the number of transactions so they’re done in parallel by different units. And then there’s proof of stake.

Proof of stake is where the validators who are managing the transactions are staking or putting up some collateral to the degree that they determine how many of the transactions they are apportioned. The more they invest, the more transactions they get, and the more profitable it is to them. You still have consensus mechanisms. But the evolution towards proof of stake plus sharding is a way to preserve the security and decentralization of the network while increasing its scalability.

Come for the Money, Stay for the Paradigm Shift

Susanna: The early adopters of blockchain were cryptocurrency traders. In fact, it’s popular right now to say that crypto has simply been rebranded as Web3. And there’s another saying: “Come for the money, stay for the paradigm shift.” What would you say are some of the other attractions bringing people into this space?

Ron: Bitcoin was the first functional blockchain network, and it was all about the currency. But there’s not much you can do with the Bitcoin network. It’s really about moving currency from point A to point B, buying and selling and trading currencies. Ethereum, a brilliant conception of Vitalik Buterin, added to the blockchain what’s called a Turing Complete computer.

It’s like the difference between a Wang word processor and a personal computer. A Wang word processor did one thing. A computer was a shape shifter, a virtual machine. You could turn it into a calculator, a game, a means of communications, because it was programmable. Ethereum is derived from cryptography, but unlike Bitcoin, it’s programmable, so you can produce other effects.

A lot of people did come in early for the cryptocurrency trading and then decentralized finance, which is about staking value. And getting huge returns on that, and borrowing against those returns. Things that are impossible to do in conventional finance are possible when you have this sort of global trustless network that can compute things. That’s the evolution of the third iteration of the web, which assumes identity ownership and transactions and computability.

And now, there’s a range of emerging chains like NEAR Protocol and Solana and Harmony, also world computers in their own right, that enable new applications and other entities like decentralized autonomous organizations.

Susanna: Let’s bring in Geoffrey Moore’s Crossing the Chasm framework for how users evolve from the early adopter stage to the early majority stage. The technologists and developers are the first enthusiasts in the space, and create the first prototypes. Then designers create better, prettier, more user-friendly interfaces so that the next set of users, the mainstream users, don’t cut themselves on the sharp corners of the technology as they’re reaching in to get what they want (like the NFTs, or the assets in their wallets). Who would you say is leading some of the latest tech developments, creating better user experiences and better interfaces in Web3?

Mainstreaming the Next Billion Users

Ron: Early on in the evolution of Web3, it’s the people who have the technical capability who are creating the experiences. And some of the experiences are just insanely bad.

For example, a few years ago, you needed to be a member of the crypto cognoscenti to buy a CryptoKitty, which was an early NFT on the Ethereum blockchain. You needed to get a wallet, you needed to add some currency in order to buy some crypto, you had to engage in a KYC [Know Your Customer] process, where you’re holding your passport up to your webcam to some nameless entity on the other end so that they can satisfy a federal requirement that you know your customers for anti-money-laundering reasons. Eventually after all this you got to trade your crypto for the CryptoKitty.

Now there’s an influx of people who are mainstreaming all of these things to get to the next billion users of Web3. UX designers, product designers, people who are eliminating friction, making it understandable so that people know what they’re doing, and aren’t frightened off.

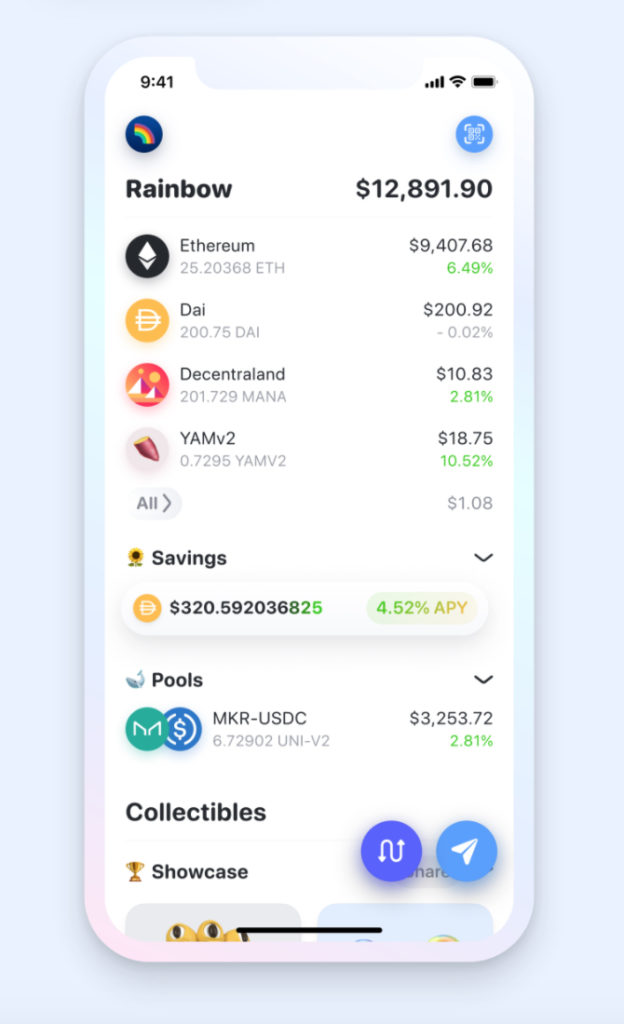

Rainbow and the NEAR Protocol are making it possible for mainstream audiences to easily set up wallets, make purchases, set up account relationships. Creative technologists like Matt Lockyer are very focused on mainstreaming user experiences. Mike Demarais and his team at Rainbow are building an Ethereum wallet for iOS with a lovely, state-of-the-art design and UX. MetaMask is expanding capabilities and ease of use for its wallet, which also effectively serves as a login gateway to other blockchain apps. Even Coinbase has done a good job at onboarding millions of crypto holders for currency transactions. They have a great UX team and they know the value of user experience and simplicity so that people know what to expect. And they’ll be launching an NFT marketplace in the coming weeks. Of course, OpenSea too, which has emerged as a kind of eBay for NFTs.

I’d say that’s the current state of Web3, focusing now on how to get the next billion users.

Susanna: Clear messaging is a good start. So, thank you for breaking it down for us. Next week, we’ll talk DAOs.